Advertisements

We all dream about sitting on a beach drinking mimosas in our final years. When we enter the workforce, we prepare to spend a good 40 years working hard to save enough money to retire early.

After55.com

It can feel like saving for a complete retirement can be a constant strain. We’ve outlined some little habits we can adopt in our day-to-lives that can help us save thousands of dollars a year.

Do you have the tactics to retire early? Read our list and find out!

Turn Off The Devices

The more time we spend looking at screens, the more chance there is we will be exposed to advertisements. They are designed to get us to spend money, and so it is worth just avoiding them together. It’s ok to swap television for a book, and save on your electrical bills along the way.

Getty Images

You’ll be amazed by how much you can save when you’re not playing hours of TV a day. And you won’t be exposed to more tempting purchases, either!

Sign Up To Reward Programs

This is a great way to save small amounts often – resulting in hundreds of pounds a month. Always be mindful of deals in supermarkets, such as 2 for 1, 50% off, or stamp reward programs.

Credit: Pinterest

By stocking up on items when they are reduced, you can save enough to buy other things or put the loose change away for a rainy day. Make sure to signup to all relevant programs in the places you visit most.

Sell Your Extra Assets

You’ll be amazed by how many things you have round the house that you don’t need. The books, CDs, DVDs, or additional clothes that you don’t use could add up to some much-needed savings. Do you really need all those books you haven’t touched in years?

Credit: Getty

You’ll be amazed by how much money you can earn by selling your old assets, as well as the mental benefits you’ll gain from clearing out any baggage you might be subconsciously holding on to.

Adopt The ‘30-Day Rule’

Some of the biggest ways we spend money are in our impulse purchases. Whether it’s ‘just one more beer’ with your friends, or a click tap on an app – those all add up. The 30-day-rule aims to curb your impulse buys by withholding your instant fix-purchases.

Credit: mihap – stock.adobe.com

If you wait 30 days, you will be able to rationally decide if you truly need the product or service you were thinking of getting. Studies show people can save thousands each year.

Stick To Your Shopping Lists

The most dangerous thing you can do is go food shopping on an empty stomach! It’s so easy for us to indulge in gratuitous treats that could be a waste of money and calories! Next time you go food shopping, try to be as full as you can be and keep to a strict list of essential items.

Credit: Shutterstock

This way, you will save money and keep a healthy diet. It also helps to buy items that can be used for multiple dishes, like pasta, as opposed to a one-off ready meal.

Host At Home

Sometimes, the best evenings are ones with your friends and a nice board game. Going out to bars and restaurants can be fun, but they also pose the threat of hefty bar tabs. You can have an amazing night with close friends by entertaining at home.

Credit: Tasting Table

For just a few dollars, people can bring their own dish or drink and spend hours having fun. These are more intimate evenings and can save you hundreds of dollars a month!

Repair Clothing

How many times have you thrown away a t-shirt just because there’s a small rip in it? Too many of us rush to replace our clothes instead of a working to repair them. By stitching or sewing your items, you can add months or years on to their lifespan.

Credit: Shutterstock

When we continue to buy more clothes, all we’re doing is spending money on things we don’t need. Also, how many t-shirts do you even need? It’s always better to be frugal.

Negotiate Your Bank Rates

This is something that banks hope you will never do! Banks take advantage of too many people when it comes to setting interest and mortgage rates. The truth is, they are always willing to negotiate these terms to keep your business.

Credit: Shutterstock

You’ll have to be a bit sneaky with this one: they will try to get you to back down! It’s important to stand your ground and tell them you’ll move banks unless you get a better deal. You will save thousands of dollars a year!

Complete Your Books/Video Games

This writer is guilty of this one: halfway through a good book but the temptation is just too high – I rush to buy three more! There are countless books on my shelf that I haven’t got round to even touching yet. The same goes for video games, too.

Credit: Getty Images

Try to save a bit of money by delaying your next purchase of an item until you finish your current book or game. There’s no need for them to take up space and finance until it’s necessary.

Drink Less Alcohol, More Water

Just a few beers with friends can rack up $30 dollars a pop. If you’re a social creature and meet with friends a few times a week, that’s hundreds of dollars spent just on casual meetups. It’s cheaper and healthier to stick to water when you go to the bar.

karenmccoll.com

Save the alcohol for a weekend activity and watch your bank balance benefit from it. Also – drinking alcohol at a bar each night isn’t sustainable as a lifestyle.

Stop Smoking!

This one should be obvious for more reasons than saving money. It’s unhealthy, unsocial, expensive, and will slowly and painfully kill you. Each year, smokers spend thousands of dollars smoking and making themselves sick in the process.

Credit: Shutterstock

Cigarettes are the single biggest waste of money with no positive outcome for anyone. It is no longer cool, acceptable, or impressive. In fact, if you do it you probably won’t even have a retirement to enjoy because you’ll die at 50. Don’t do it.

Avoid Convenience Food

It can be easy to pick up a quick sandwich around the corner from your office each day. Did you know that you could save dozens of dollars each week by packing your own lunch?

Credit: Getty Images

End your weekend by making large amounts of pasta or casseroles that you can store in the fridge and take to work. This will also keep your diet regulated and balanced. Another way to save the small change is to resist those late-night fast food joints!

Keep The Lights Off!

Electricity bills can be expansive and creep up on you in unwanted ways. It’s a good incentive to turn the lights off when you leave the house and watch those bills reduce over time.

Credit: Architectural Digest

During the day, try to rely on the natural light available from windows and regulate the heating to specific times of the day. This act of frugality will also carry into other parts of your life and improve other bills and savings.

Change Your Lightbulbs To LED

Energy-efficient light bulbs might be a more expensive purchase at the time, but the benefits can last months. The bulbs will not need to be changed as much since they use less energy.

Credit: NBL Electrics

Going LED or CFL (compact fluorescent lamp) can save up to $45 a year and generally improve the lighting around the house. Next time a bulb goes out, make sure to invest in new bulbs that can save you time and money.

Don’t Build Credit

This is a troubling circle that can get you stuck in a routine for years. It’s a simple rule: don’t spend money you don’t have. Everyone should have one for emergencies, but you should generally keep it out of your wallet.

Credit: Upgraded Points

Credit cards are a dangerous way to rack up debt which could take years to pay off. You should start by paying off any existing debts you already owe but don’t use it for anything new.

Do Price Comparisons

Don’t buy the first deal you see. The chances are that you will be able to find the same thing, or at least something similar, for a cheaper cost. Explore different grocery stores or examine which gadget gets you what you need for a lesser price.

Credit: Citizen Advice

By getting into the habit of getting different things at different stores, you’ll save money where it matters: your essential items. Phone plans, internet packages, and holiday bundles should all be assessed for future lifestyles!

Aim To Make Your Own

Whether it be cooking of gift-giving, nothing is as meaningful as a handmade item. You can make candles, foods, bread, cookies, and plenty of other things at a fraction of the cost of buying them in a shop.

Fiskars

People don’t send birthday cards nowadays, but if they did a handmade one would be far more meaningful. Also, making things yourself means you can put your personal touch on things without spending too much money instead.

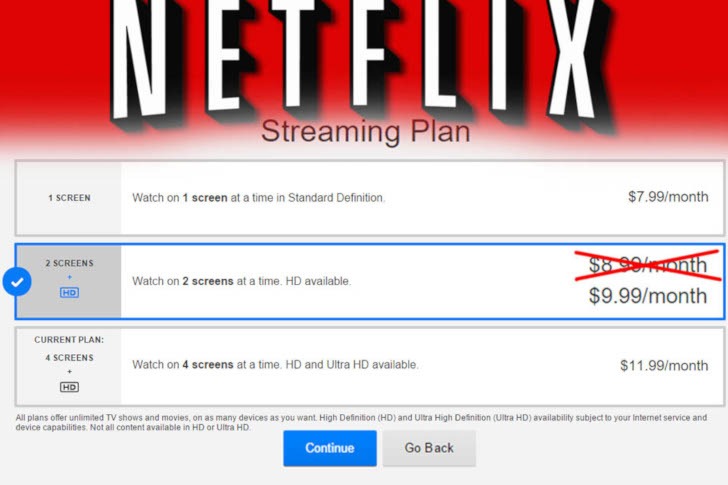

Cancel Unused Subscriptions

When was the last time you logged on to Netflix? Even if you do use it, do you need the large bundle when the small one will do? People spend hundreds of dollars on fast internet they don’t use, content bundles they don’t watch, or memberships they don’t use.

Credit: AVS Forum

Carefully examine your lifestyle and see if you need every service you are paying for. Then, spend a day cutting off or reducing the ones you don’t use.

Buy Second Hand

Places like Amazon offer books and DVDs at a fraction of the cost when they are resold by users. You can buy books for cents instead of dollars, and save money along the way. There isn’t a need to have the newest item possible, especially if it’s something modest and impersonal.

Credit: Pixabay

Next time you are shopping online, consider buying second hand and saving a few bucks. Adopting this lifestyle can save you thousands over the next years.

Give The Gift of Labor

You don’t always have to spend money to give a gift. As we get older, time becomes just as valuable as our money or possessions. Why not gift your friends by babysitting their children or helping them move house?

Credit: Move Now Properties

Labors of love can be greatly appreciated by the recipient and do wonders for both of you. Next time a busy birthday period comes up, consider giving your time as a gift, saving money and helping build on your relationships.